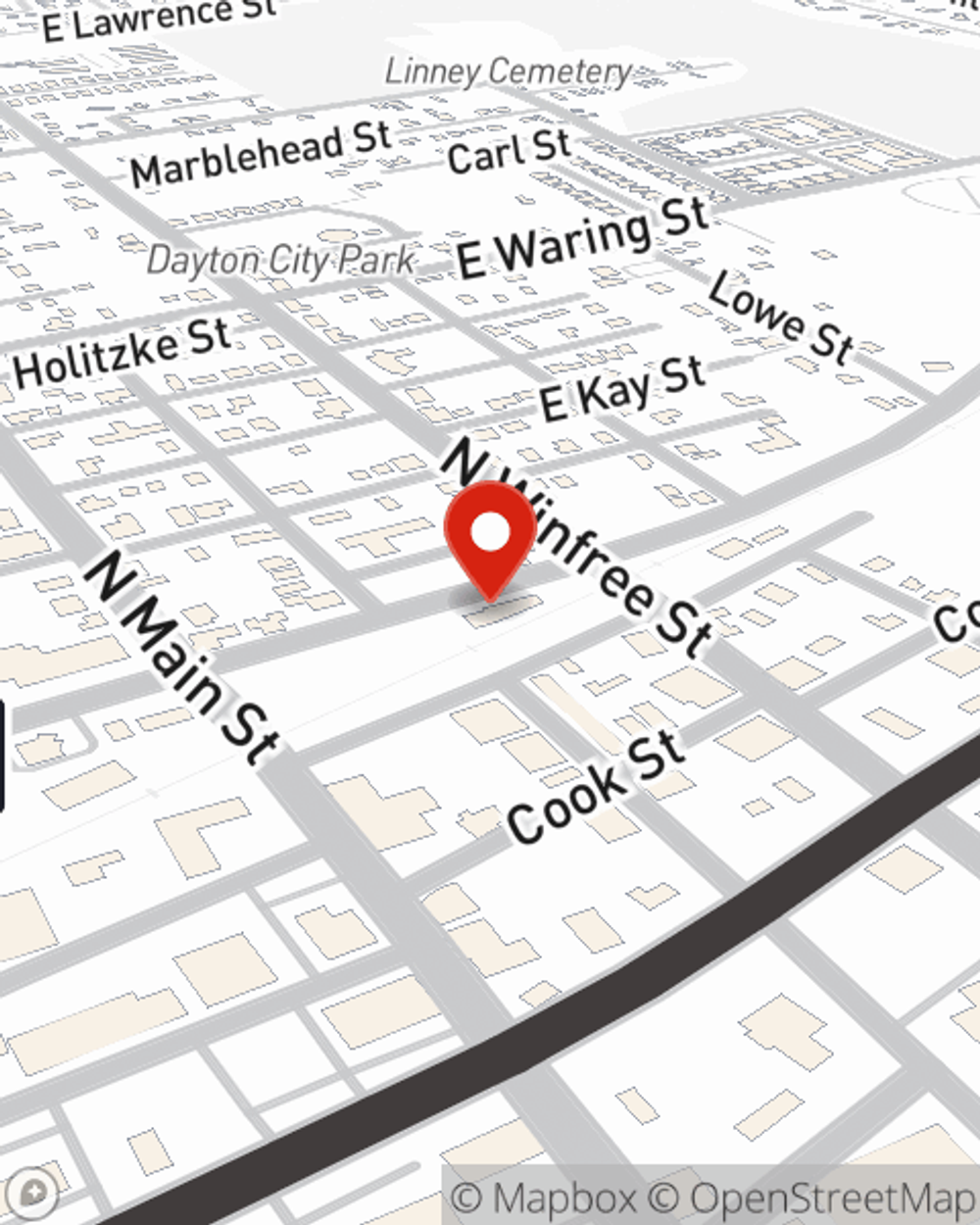

Renters Insurance in and around Dayton

Your renters insurance search is over, Dayton

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your tablet to your boots. Unsure how to choose a level of coverage? We have answers! Juan Carranco wants to help you assess your needs and help secure your belongings today.

Your renters insurance search is over, Dayton

Your belongings say p-lease and thank you to renters insurance

Agent Juan Carranco, At Your Service

Renting a home is the right choice for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may take care of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps shield your personal possessions in case of the unexpected.

There's no better time than the present! Reach out to Juan Carranco's office today to learn more about State Farm's coverage and savings options.

Have More Questions About Renters Insurance?

Call Juan at (936) 258-8218 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Juan Carranco

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.